The power to pollute increasingly carries a hefty price tag.

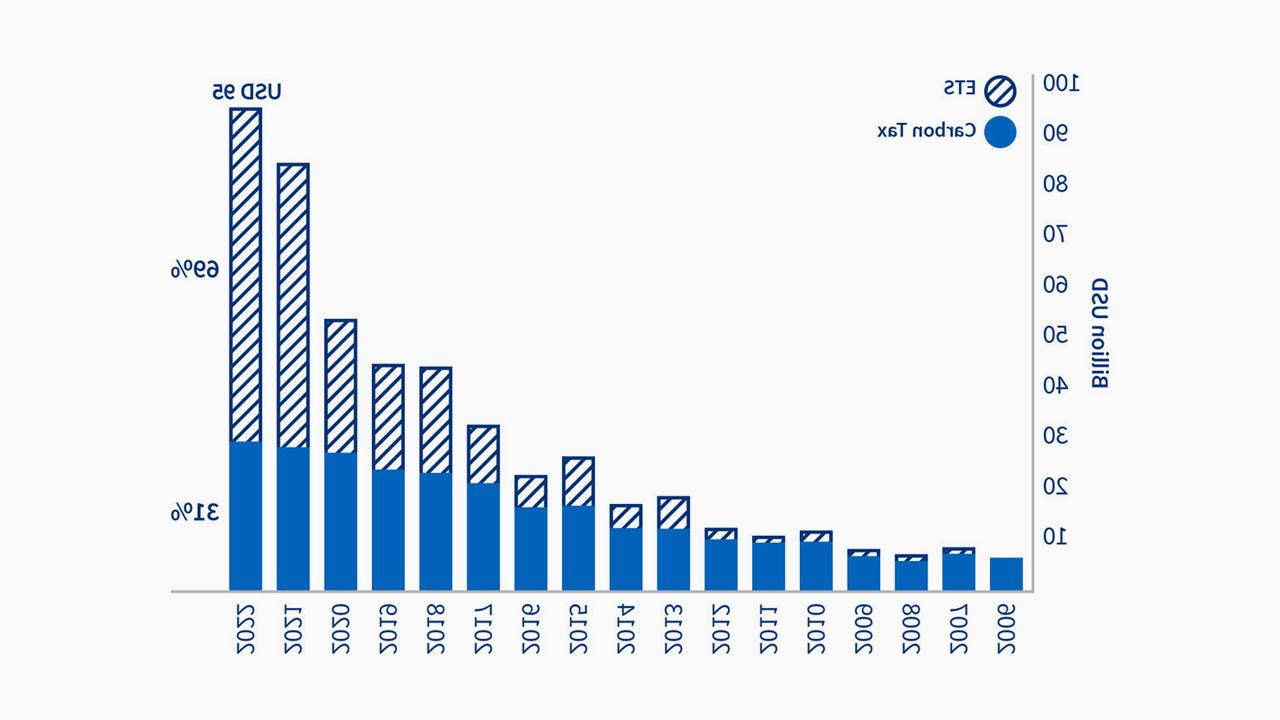

According to the World Bank’s Carbon Pricing Dashboard, nearly one quarter of the world’s greenhouse gas (GHG) emissions are now covered by some type of carbon pricing. Global revenues from emissions trading and carbon taxes soared to $100 billion by the end of 2022. As of June 2023, 73 emissions trading systems (ETS) had been implemented worldwide—a number that continues to climb.

So, are carbon markets working? If numbers don’t lie, the answer must be “yes.”

Carbon pricing favors green innovation, forcing those who burn fossil fuels into a competitive disadvantage. Article 6 of the Paris Agreement and the rules approved at COP26 made carbon market mechanisms more standardized, transparent, and fair. This prompted governments and international development actors to crank up the pace on deploying Article 6 frameworks, generating the momentum and structure needed to implement specific carbon trading projects.

Japan’s A6IP mobilizes climate action

Japan launched the Paris Agreement Article 6 Implementation Partnership (A6IP) at COP27 in November 2022. The A6IP’s goal for this year is to deliver a capacity-building program that supports operationalization of Article 6. Capacity building further enables emerging economies to join high-income nations in adopting carbon trading.

To that end, the A6IP published Sharing Best Practices and Lessons Learned from Capacity Building for Implementation of Article 6, a collection of results from its official side event at COP27. Its three thematic working groups—authorization, reporting, and tracking—aim to share the processes, institutional arrangements, and tools countries are using to implement Article 6.

The A6IP’s membership roster has grown fast. As of April, it included more than 60 countries; 6 United Nations agencies; 4 major multilateral development banks; and more than a dozen organizations. Tetra Tech joined the A6IP immediately after its launch.

The G7 Ministers’ Meeting on Climate, Energy and Environment adopted the Principles of High Integrity Carbon Markets, coinciding with the announcement of the creation of the Article 6 Implementation Partnership Center at the Institute for Global Environmental Strategies (IGES). These efforts aim to facilitate Article 6 deployment by addressing common challenges and offering solutions. The AI6P will present its progress at COP28.

Cooperative agreements take shape

On the operational side, Japan continues to advance deployment of its Joint Crediting Mechanism. Similarly, Switzerland is progressing on its bilateral climate agreements, which set the framework and requirements for recognition of Internationally Traded Mitigation Outcomes (ITMO) and established a legal basis for commercial contracts between buyers and sellers of emission reductions. The Swiss government has signed 12 bilateral agreements thus far, including two that are now registered: one on smart agriculture in Ghana and a second on e-buses in Thailand, which “will help avoid around 500,000 tonnes of CO2 by 2030.” South Korea is also conducting Article 6 bilateral negotiations with major GHG emitters, while Singapore and Papua New Guinea signed a memorandum of understanding with the same purpose.

Bilateral Agreements Since 2013

| Aquiring Country | Transferring Countries |

|---|---|

| Singapore | Cambodia, Colombia, Morocco, Papua New Guinea, Peru, Vietnam |

| Japan | Azerbaijan, Bangladesh, Cambodia, Chile, Costa Rica, Ethiopia, Georgia, India, Indonesia, Kenya, Lao PDR, Maldives, Mexico, Moldova, Mongolia, Myanmar, Palau, Papua New Guinea, Philippines, Saudi Arabia, Senegal, Sri Lanka, Thailand, Tunisia, Uzbekistan |

| Sweden | Dominican Republic, Ghana, Nepal |

| Republic of Korea | Mongolia, Vietnam |

| Australia | Fiji, Papua New Guinea |

| Switzerland | Dominica, Ghana, Georgia, Morrocco, Peru, Thailand, Senegal, Ukraine, Uruguay, Vanuatu |

Article 6.2 Bilateral Agreements as of April 1, 2023 (World Bank. 2023. State and Trends of Carbon Pricing 2023. Washington, DC: World Bank. doi: 10.1596/978-1-4648-2006-9. License: Creative Commons Attribution CC BY 3.0 IGO)

Article 6 established “corresponding adjustments” as an accounting mechanism to avoid double counting of emission reductions. Countries transferring ITMOs must add an equivalent amount to their emission levels in their biannual transparency reports. At the same time, countries using emission reductions can subtract that amount from their emission levels. Only ITMOs officially authorized by countries will be subject to corresponding adjustments. Projects that secure corresponding adjustments are the main target of bilateral buyers.

A slightly different bilateral approach is Supporting Preparedness for Article 6 Cooperation (SPAR6C), a EUR$20 million (USD$20.94 million) program funded by Germany. SPAR6C supports countries to participate in the Article 6 carbon markets without a bilateral obligation to exchange ITMOs with Germany. The program focuses on long-term planning, institutional readiness, pilot design, and knowledge sharing, and beneficiaries include Zambia, Colombia, Pakistan, and Thailand. SPAR6C aims to contribute to the establishment of structures, procedures, and regulatory frameworks in the four countries. The ITMOs generated under SPAR6C are not, in principle, intended to be retired by the German government, so could potentially be traded with other countries.

Tetra Tech leads early Article 6 projects in Malawi and Zambia

Through Modern Cooking for Healthy Forests in Malawi, we are assessing options for switching from fossil fuels to sustainable bioenergy resources in thermal generation and electricity production at agro-industrial companies. Our experts evaluate two factors: the potential carbon credits generated by the fuel switch and the feasibility of using Article 6 mechanisms to generate additional sources of revenue. The results might help the Government of Malawi produce a case study for presentation at COP28. Such a study could lay the foundation for the development of regulations and an institutional framework for deployment and scaling up of Article 6.2, which governs the cooperative approaches between countries and private sector companies.

In Zambia, under the Alternatives to Charcoal program, Tetra Tech’s sustainable energy finance team is compiling a history of carbon markets and their application to clean cooking, an area that has been the subject of intense criticism due to concerns about lack of transparency, unfair distribution of benefits, and overestimation of carbon credits in projects. The aim is to analyze the business models of clean cooking carbon finance programs and assess how these same programs could be implemented under the new Article 6 market mechanisms in a way that brings more local benefits, enhances investor confidence, and lays the groundwork for Zambia to implement a clean cooking program.

Part of the Article 6 vanguard, Tetra Tech’s climate change team is building capacity around Article 6 by initiating projects that will be among the first to implement its mechanisms. We stand ready to help governments and market players assess carbon markets in their countries and determine the best use of Article 6 to facilitate the energy transition.

Learn more about carbon markets, how they drive development, and Europe’s new carbon border adjustment mechanism.

Read more from Rodrigo about how Article 6 of the Paris Agreement can spur the clean energy transition:

About the author

Rodrigo Chaparro

Rodrigo Chaparro is a sustainable energy and climate change specialist.

Rodrigo has more than 20 years of experience implementing cost-effective solutions that promote growth with minimum climate impact. He has deployed risk mitigation instruments for energy investments, financing mechanisms for decarbonization projects, and technical and policy solutions for renewable energy and energy efficiency applications.

Rodrigo has extensive experience managing major initiatives from international donors, including multilateral banks, the U.S. government, the United Nations, and Japanese and Danish aid agencies. At the Inter-American Development Bank, he led the implementation of the Energy Savings Insurance Program and supported the design of new loans and technical assistance in sustainable transport and battery energy storage.

Rodrigo holds bachelor’s and master’s degrees in Chemical Engineering from the National University of Colombia. He has lived in Colombia, Germany, and the United States and is fluent in English and Spanish.